The Kendrick Road

Project Story

Where It All Began

This project began through my Mastermind training group, where I was introduced to Heather Smail, founder of a high-performing UK property company recognised for its excellence in project management and communication.

From the very first conversation, it was clear that Heather’s team operated with precision and professionalism. Their company integrates every discipline required for a full property transformation, architecture, interior design, construction management, and compliance, all under one roof.

This collaboration marked the start of a project built on structure, trust, and data-driven decision-making.

The Project Plan

Heather’s company presented a clear and structured proposal for 10 Kendrick Road, Nottingham NG3, a semi-detached property purchased below market value, with the goal of converting it into a 6-bed HMO (five studios and one ensuite).

The plan included:

A detailed renovation and design scope

Transparent cost and value breakdown

Realistic rental and refinancing projections

Full project management by their integrated team

Verifying the Numbers

Before any project receives approval, every assumption must be tested.

That means verifying:

Market comparables in the local area

Rental demand trends

Long-term capital growth potential

For Kendrick Road, I performed an independent data analysis covering vacancy rates, rent levels, and local value per square metre.

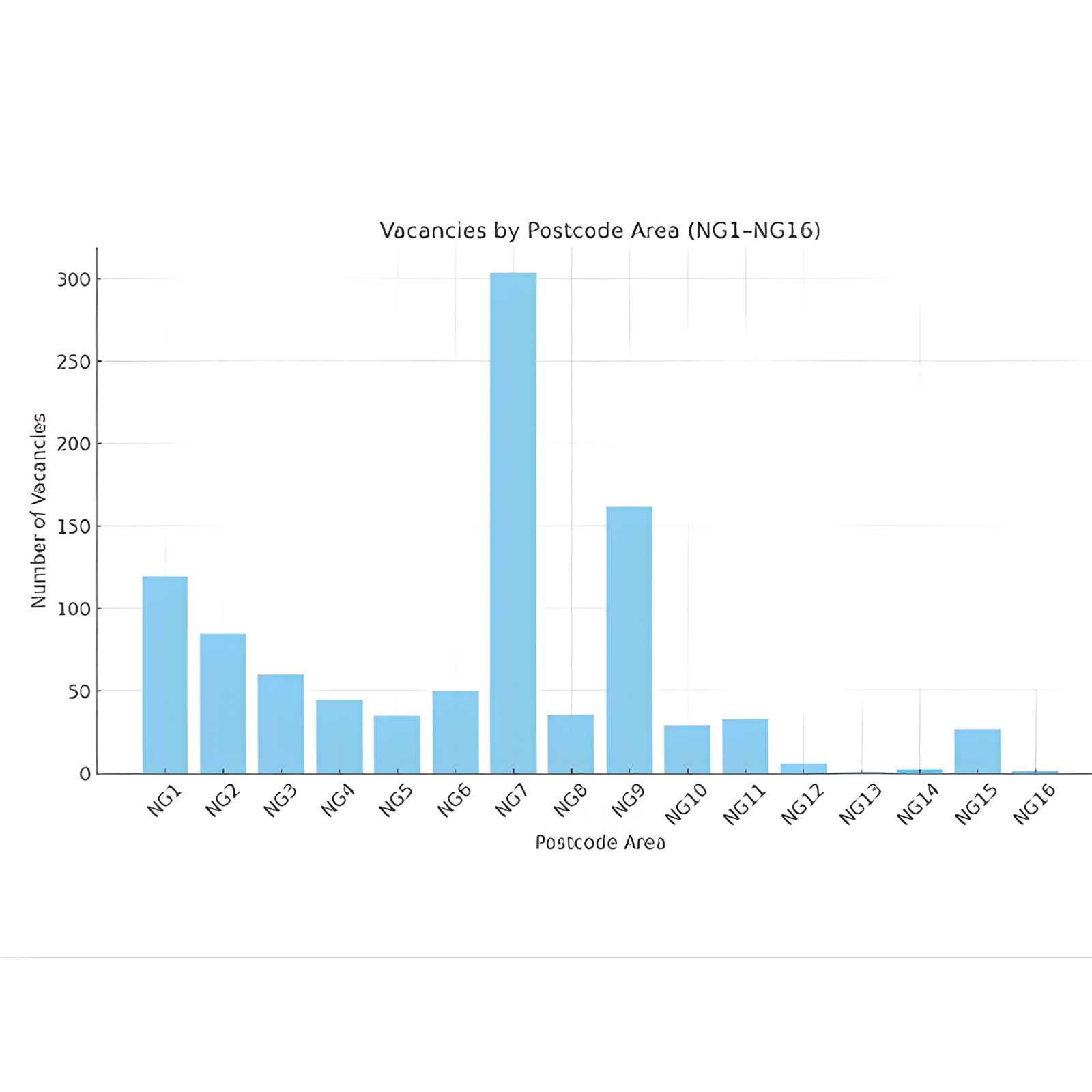

Vacancy Data: Understanding Demand

This chart shows the number of rental vacancies across Nottingham postcodes (NG1–NG16).

The highest vacancy levels appear in NG7 and NG8, indicating areas of high rental activity and turnover.

NG3, where Kendrick Road is located, shows moderate vacancy, suggesting steady demand with limited competition.

This balance makes NG3 an attractive investment area.

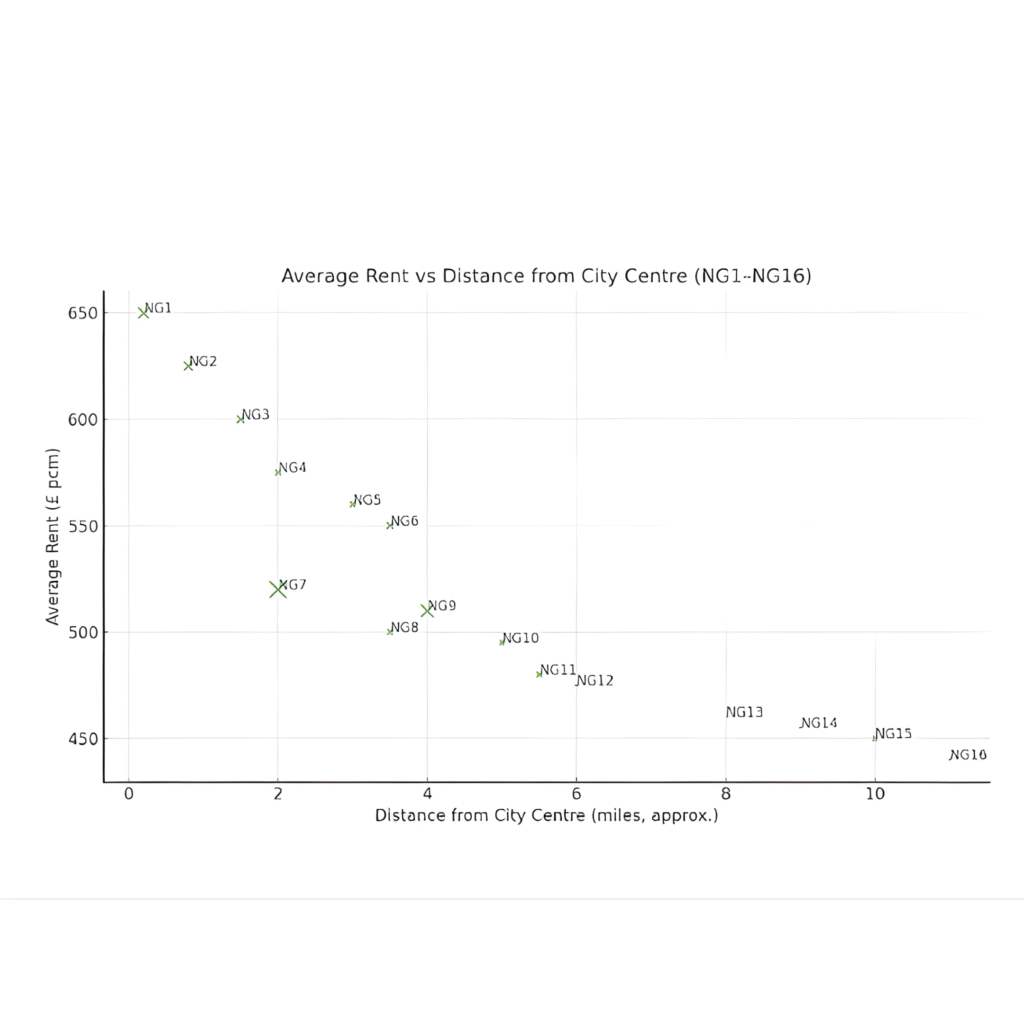

Rent vs Distance: The Affordability Curve

This scatter plot compares average rent (£ per calendar month) against distance from Nottingham city centre.

As expected, rents decrease gradually the farther you move from the centre.

NG3 sits within the inner-city ring, maintaining strong rental values (~£600 pcm) while offering slightly lower entry costs than NG1 or NG2.

This reinforces NG3’s position as a high-yield, accessible location.

Seeing It First-Hand

Data alone doesn’t tell the whole story.

That’s why I always visit the property myself, to walk the neighbourhood, meet locals, and observe details the data can’t capture:

Street quality and surrounding property conditions

Access to transport links and local amenities

The overall feel and character of the area

These visits often confirm, or occasionally challenge, the data-driven assumptions, helping refine the investment outlook.

The Green Light

Only after verifying the plan, data, and on-site assessment does a project receive the green light.

At this stage, Heather’s integrated team begins renovation, ensuring every step meets compliance, design, and cost standards.

Investors receive progress updates throughout, maintaining full clarity and confidence.

Understanding the Value: Price per Square Metre

This comparison illustrates how Kendrick Road properties outperform the NG3 postcode average:

NG3 average: £2,033 per m²

10 Kendrick Rd (current): £1,699 per m², below average, indicating uplift potential after renovation

11–16 Kendrick Rd: £2,447–£2,685 per m², demonstrating strong nearby benchmarks.

This means the project begins with built-in equity, as the post-renovation valuation will align with or exceed neighbouring prices.

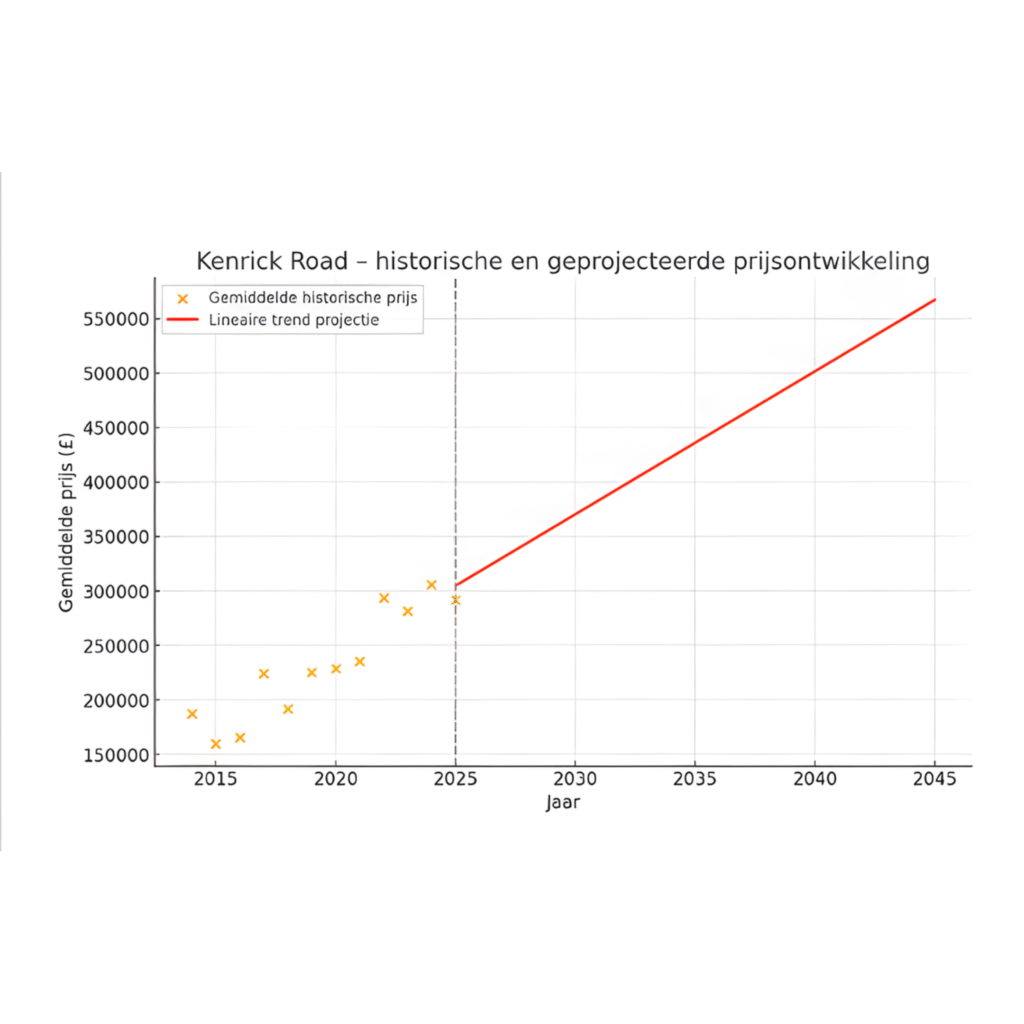

Long-Term Growth Potential

The historical and projected price trend shows consistent capital appreciation, with a linear growth projection suggesting prices could surpass £550,000 by 2045.

This reflects both the strength of Nottingham’s housing market and Kendrick Road’s specific growth trajectory.

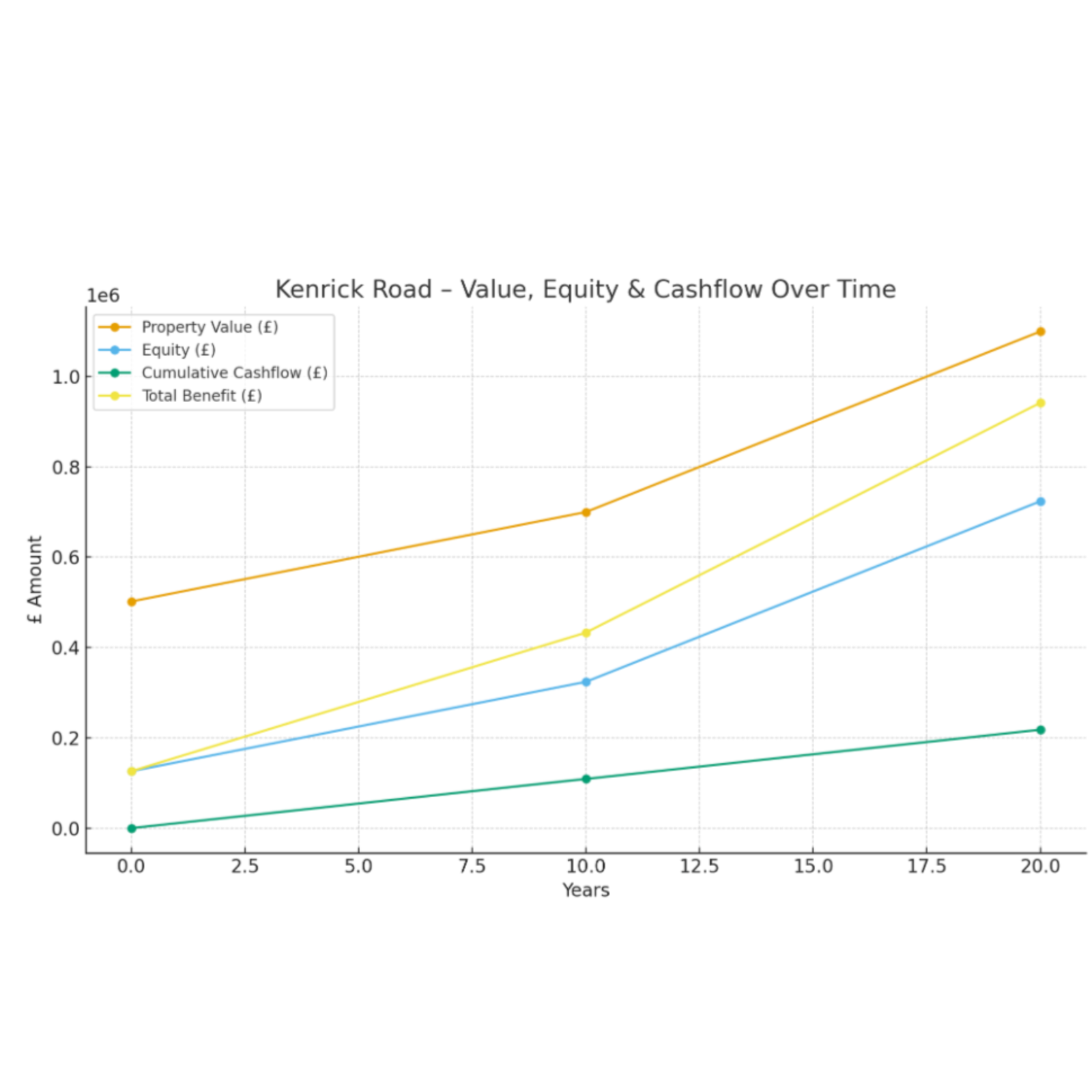

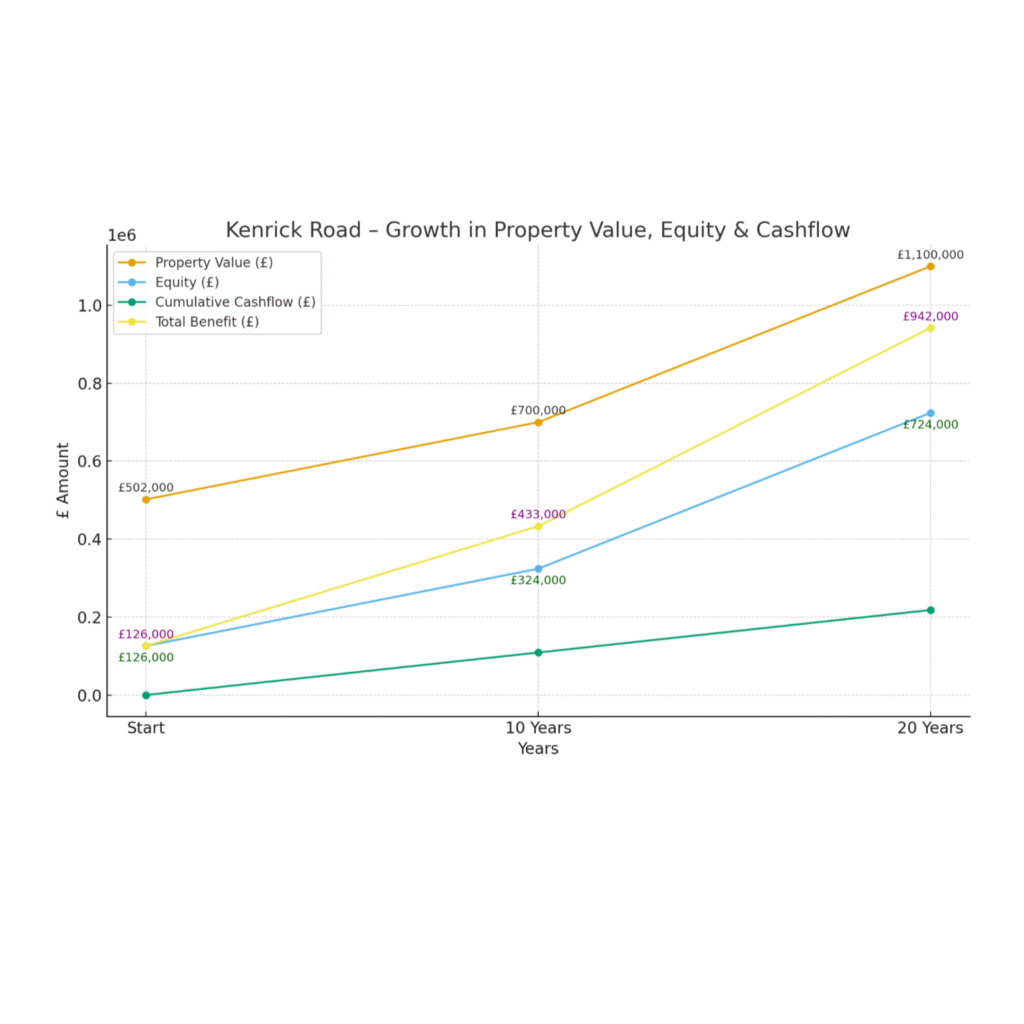

Value, Equity & Cashflow Over Time

The next stage models the combined impact of property value growth, equity buildup, and rental cashflow over 20 years:

Property value rises steadily, crossing £1.1M by year 20.

Equity builds consistently, supported by refinancing and mortgage reduction.

Cumulative cashflow adds a further layer of long-term return.

Each factor contributes to the total financial benefit, showing how time and compounding work together in property investment.

Growth Overview

This chart summarises key milestones:

Start value: £502,000

10-year projection: £700,000 property value, £433,000 equity, £324,000 cashflow

20-year projection: £1.1M property value, £724,000 equity, £942,000 total benefit

This demonstrates how a well-structured, data-backed project transforms into sustained growth over time.

Ongoing Updates

The Kendrick Road project is more than an investment, it’s a case study in evidence-based decision-making.

As renovation progresses, I’ll continue to share updates showing each milestone, from construction to completion, and the verified financial outcomes.

Follow this space to see how data, trust, and partnership create real, measurable impact in UK property investing.